Dear Shareholders,

Sun Peak Metals Corp. (“Sun Peak”) is preparing for a public listing of Sun Peak shares on the TSX Venture Exchange (“TSXV”). Sun Peak has filed a listing application with the TSXV and a preliminary long form prospectus with the securities commissions on Sun Peak’s profile on www.sedar.com, along with two independently prepared NI 43-101 technical reports. One report focuses on the exploration potential of the Shire Project comprising Sun Peak’s interests in the Terer, Nefasit and Adi Da-iro exploration licenses (“ELs”) and a second report focuses on the Meli Project, all located in the Arabian-Nubian Shield in Ethiopia. After filing the preliminary prospectus, the TSXV and the BCSC will review and deliver comments to Sun Peak. Sun Peak is targeting the end of March or early April 2020 for completion of the process.

Capital

Sun Peak raised a total of C$12.8 million from the issue of 36,696,869 special warrants priced at $0.35 and C$1 million from the issue of 2,500,000 common shares priced at $0.40 both in late December 2019.

Once the BCSC completes the final review process and receipt of the prospectus is final, each special warrant will automatically be converted into Sun Peak common shares, and all of Sun Peak’s shares will be listed on the TSXV and Sun Peak will begin trading. This process should occur over a 3-day period according to the following schedule:

Day 1 – BCSC completes review process and issues a receipt for the final prospectus,

Day 2 – Each special warrant will automatically be converted into Sun Peak common shares,

Day 3 – Sun Peak shares will be listed on the TSXV and the company will commence trading.

Upon conversion of the special warrants, Sun Peak’s share structure will be as follows:

| Common Shares Issued and Outstanding | 78,438,634 |

| Share Purchase Warrants | 8,957,130 |

| Stock Options | 4,100,000 |

| Fully Diluted | 91,495,764 |

The Shire Project

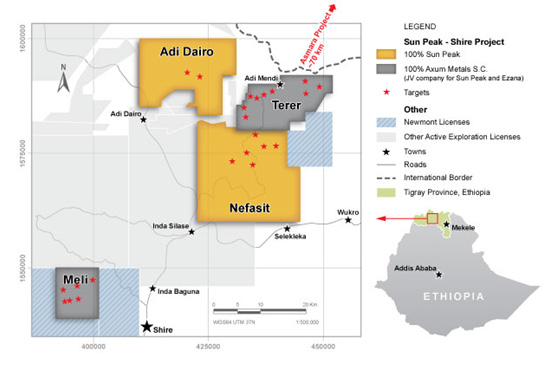

The Shire Project is comprised of four exploration licenses covering approximately 1000 square kilometers in the Tigray Region of northern Ethiopia.

The Meli and Terer Licenses are part of a joint venture agreement with Ezana Mining, a private Ethiopian corporation. The Nefasit and Adi Da-iro licenses are held 100% by Sun Peak (see map below).

The licenses are located within the Arabian Nubian Shield in the same geological environment and trend as the Bisha Mine and Asmara Project in Eritrea.

The Joint Venture Projects

Sun Peak entered into a corporate joint venture agreement (the “JV Agreement”) in 2017 with Ezana Mining Development plc (“Ezana”), which governs the funding and activities of Axum Metals SC (“Axum”).

Pursuant to the JV Agreement, Sun Peak has an option to earn up to a 70% interest in Axum, which holds the JV Properties (the Terer EL and the Meli EL). The respective interests of Sun Peak and Ezana in Axum during the earn-in period are set out in the table below:

| Shareholder | Effective Date | Completion of Phase 1 | Completion of Phase 2 | Phase 3 (purchase of 2.5%) |

| Sun Peak | 0% | 51% | 67.5% | 70% |

| Ezana | 100% | 49% | 32.5% | 30% |

To acquire a 51% ownership in Axum, Sun Peak must solely fund Axum’s exploration expenditures (and other qualifying expenses) on the JV Properties totalling US$5,000,000 by December 4, 2022, with at least US$2,000,000 of such expenditures being incurred by June 4, 2021 (the “Phase 1 Earn-in”). At January 31, 2020, Sun Peak has spent approximately US$ 1,000,000 of that total. If Sun Peak elects to proceed with the exercise of the Phase 2 Earn-in, Sun Peak will continue to solely fund Axum’s exploration expenditures at a minimum rate of US$1,000,000 for each one year period following the date of Sun Peak’s election to exercise the Phase 2 Earn-in, to advance the JV Properties through to completion of a definitive feasibility study and the completion of any other studies required to apply for a mining license (the “Phase 2 Earn-in”) after which Axum will then apply for a mining license.

Upon receipt of the feasibility study, the board of directors of Axum will determine whether Axum will proceed with development of the JV Properties. Within 60 days of Axum being granted a mining license on some or all of the JV Properties, the Company will have an option to purchase 2.5% of the shares of Axum held by Ezana for a purchase price of US$6,000,000, which would result in the Company owning a 70% interest in Axum.

During the Phase 1 Earn-in and Phase 2 Earn-in, all programs on the JV Properties will be funded, designed and managed solely by Sun Peak. After the Phase 2 Earn-in is completed and a mining license is granted, the shareholders of Axum will jointly seek funding from financial institutions for the development of the mine, and work programs and operations will be funded by the shareholders of Axum on a pro-rata basis in proportion to their respective shareholdings in Axum. Pursuant to the terms of the JV Agreement, Ezana or its nominee is entitled, upon acquiring the necessary licenses, to exclusively conduct precious metal mining activities for its exclusive benefit on the oxide gold caps located above the massive sulphide zone on the JV Properties.

Sun Peak can terminate the JV Agreement at any time, but it will forfeit any interest it would have otherwise earned.

The Terer and Meli exploration licenses (“Els”) are held by Axum and Sun Peak is indirectly earning into those two EL’s pursuant to the JV Agreement.

Terer EL

The Terer EL was issued to Ezana on March 30, 2015 and transferred to Axum on June 12, 2019. The Terer EL has been renewed twice, with the second renewal covering an area of approximately 181 square kilometres and is set to expire on March 29, 2020. The license requires the holder to spend approximately US$563,378 by the anniversary date. Axum has made the application to renew the exploration license and expects it will be renewed for additional terms. Renewal of the Terer EL may require a relinquishment of one quarter of the area covered by the license.

Meli EL

The Meli EL (covering an area that had previously been subject to an EL owned by Ezana) was issued to Axum on December 4, 2019. It has an initial term of three years and covers an area of approximately 98 square kilometres. The license requires the holder to spend approximately US$2,114,225 during its current term.

100% Held Sun Peak Projects

In addition to entering into the JV Agreement, Sun Peak also organized a wholly owned subsidiary, Sun Peak Ethiopia Mining PLC (“Sun Peak Ethiopia”) under the provisions of the Commercial Code of Ethiopia on October 3, 2016.

Sun Peak Ethiopia made application for and now holds on a 100% basis, the Nefasit EL and the Adi Da-iro EL.

Nefasit EL

The Nefasit EL was issued to Sun Peak Ethiopia on January 1, 2018. It has an initial term of three years and covers an area of approximately 431 square kilometres. The license requires the holder to spend approximately US$1,239,198 during its current term.

Adi Da-iro EL

The Adi Da-iro EL was issued to Sun Peak Ethiopia on April 16, 2019. It has an initial term of three years and covers an area of approximately 269 square kilometres. The license requires the holder to spend approximately US$1,370,922 during its current term.

2020

Sun Peak’s planned programs for 2020 and its previous work on all four projects prior to the end of 2019 are described in detail in the prospectus and the two technical reports.

On behalf of the Sun Peak Team we look forward to our public listing on the TSXV in the near term and thank our shareholders for their continued support.

Sincerely,

Greg Davis

President & CEO

Email: gdavis@sunpeakmetals.com